Financing

Break your project into predictable monthly payments

With Hearth, you can see potential financing options for your upcoming project. A loan through Hearth helps you pay for your project through predictable, monthly payments without tapping into your home equity.

Why Hearth

Start your project soon

- Funding usually within 1-3 business days 1-3 business days Budget responsibly

- Fixed monthly payments and no prepayment penalties See eligibility without hurting your credit

- Pre-qualifying through Hearth doesn’t affect your credit score

How Hearth Works

Complete the loan request: Just answer a few questions to see available rates without affecting your credit score.1

- Review loan options: If eligible, you’ll view personalized options from multiple lending partners.

- You can choose which one best suits your needs apply with the lending partner.

- Get funded: If approved, you will typically get the funds in your account within 1-3 business days.

Get personalized options now at:

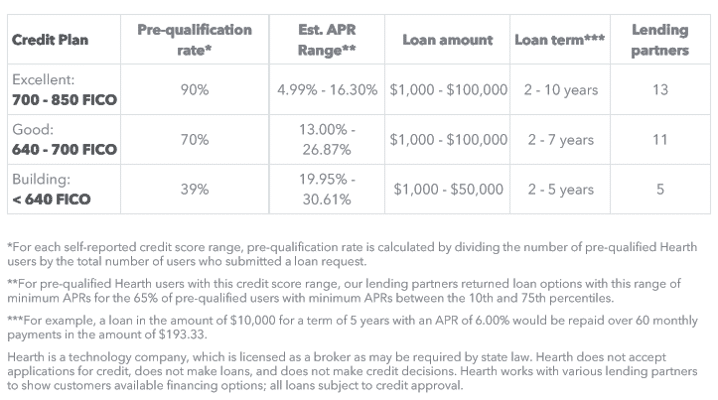

Hearth is a technology company, which is licensed as a broker as may be required by state law. Hearth does not accept applications for credit, does not make loans, and does not make credit decisions. Hearth works with various lending partners to show customers available financing options; all loans subject to credit approval.

For example, $10,000 loan with a 14.5% APR and a 36-month term would have a monthly payment of $344.21. Actual APRs will depend on factors like credit score, loan amount, loan term, and credit history. All loans are subject to credit review and approval.

FAQs

Hearth’s lending partners offer installment loans. These loans have fixed monthly payments, terms that are usually between 3 and 7 years, no home equity requirement, and no prepayment penalties.

Request a Service

Request a Service